How modern AI optimizes loan processing

Financial institutions of all shapes and sizes must perform KYC and due diligence checks. Both help verify the identity of new clients and any risks involved with doing business with them.

However, this can involve a long, tedious exchange of documents. So, how can that exchange be shorter and less time-consuming? The answer often depends on how savvy a finance company has been at using automation.

May 15, 2023 by Craig Woolard

Applying for a loan is one of the most complicated processes borrowers will experience. It’s not exactly a walk in the park for lenders, either. Many banks are stuck in traditional, manual processes. Employees spend hours on laborious, repetitive computer tasks.

Let’s look at a common example—the car loan application:

- A potential client applies for a car loan. First, a bank associate enters the client’s data into a database and assesses the risk of taking out the loan.

- If approved, the customer sends the vehicle details to the bank.

- Next, the money is processed and wired to the dealership.

- Finally, the customer provides proof of insurance and registration, which is again manually entered into the bank’s database.

Keep in touch

This is just one example of an inefficient process. Most banks offer several different loans that are handled manually across various departments.

Maintaining a database requires hundreds of steps that are painfully manual. These tasks usually involve going back and forth between different systems (or “chair-swiveling”). The extra steps delay the loan application process and severely impact the client’s experience. This is where automation can play a major role.

Technology that can eliminate manual copying and pasting between applications is a significant value proposition for legacy lenders. An automated loan processing system does away with chair-swiveling, data entry, manual document reviews, and many other tedious steps in the workflow. With automation, KYC, CDD checks, and customer onboarding processes are on the fast track.

In this post, we will cover what loan processing automation is and how legacy lenders can automate and optimize loan processing with artificial intelligence (AI). We will detail use cases for intelligent document processing (IDP) in the loan application process, where it can be applied, and why this technology is changing how traditional banks operate.

At the end of the post, you will understand IDP and how it can cut down on loan processing times in your own financial institution.

What is automated loan processing?

Automated loan processing refers to software and technology that can streamline the lending process, from the initial application to the final loan approval.

With minimal human intervention, an automated loan processing system can automate many manual tasks involved in processing a loan, including data entry, credit checks, underwriting, and document validation.

Implementing a loan automation system into a banking institution’s underwriting process reduces the time and resources required to process loans. Overall, automation improves accuracy and efficiency throughout the entire loan processing workflow.

Who benefits from loan lending process automation?

Customers

Loan automation doesn’t just help financial institutions. In addition to improving the efficiency of the loan processing workflow, this technology provides borrowers with a more convenient loan application experience. Faster access to funds is what it’s all about for customers. Less friction in the onboarding process enhances the customer journey and improves customer satisfaction.

Financial institutions

Successfully processing each application involves extracting hundreds of data points and analyzing all of them to assess financial risk. With the proliferation of online lenders like Rocket Loans and other fintech startups, consumers expect near-instantaneous application approvals. But according to research by Ellie Mae—legacy lenders average 52 days to process a mortgage manually—from the date the application is submitted to the date the loan is disbursed.

Banking employees

The main goal of loan automation is to streamline the lending process, making it faster, more accurate, and more efficient for both lenders and borrowers. The technology behind automation can also help employees.

Loan officers handle many documents with data about a borrower’s income. Additionally, underwriters can review 20–30 data points per document. These all involve pay stubs, tax documents, bank statements, and even open-source content available on social media for a complete picture of all associated risks. Loan automation eliminates all of this manual work, allowing bank employees to focus on higher-value work that generates more revenue.

Applying for a mortgage is one of the most complicated and frustrating processes homeowners will ever go through. It’s not exactly a cakewalk for lenders, either. So why not make the journey less painful for both parties? In the next section, let’s discover what makes loan automation possible and how it can offer above-human accuracy.

What makes automated loan processing possible?

Advancements in technology—such as artificial intelligence (AI), machine learning (ML), optical character recognition (OCR), and data analysis—all make it possible for lenders to process loan applications and other financial services faster and more accurately than humans.

Combining these technologies drives most of the automation solutions currently on the market. For example, OCR leads the way, which can read any document just like a human underwriter would. However, when augmented with AI, OCR can extract information into usable data and even learn to process it far more efficiently and accurately than humans.

OCR is often used with several other automation solutions, such as robotic process automation (RPA), which automates repetitive actions humans perform on computers. Combined with AI, this enables intelligent document processing (IDP) capabilities, which mimic how humans understand information and make decisions.

Additionally, the availability of cloud-based software solutions and Application Programming Interfaces (API) enables lenders to integrate their loan processing systems with other digital platforms and services, such as online banking and mobile apps, creating a more seamless and efficient lending experience for borrowers.

What are the limits of existing loan automation solutions?

Some older, legacy automation technologies—such as RPA—rely on simple “point-and-click” screen automations that replicate the manual click-work and keyboarding of human underwriters.

By mimicking repetitive human-performed tasks, legacy RPA “bot” technology removes some of the rote busywork and human error in underwriting. However, RPA breaks easily and is difficult to update whenever modern, evolving workflow processes change.

Underwriting, KYC, CDD checks, and customer onboarding are all complex processes that require a thorough review of large amounts of incoming data from unstructured documents. The loan application process is a major area where traditional RPA falls short and requires significant human intervention. Watch this demo to learn more about where RPA falls short.

Traditional RPA bots run on top of existing IT systems as a complementary solution. Since legacy RPA uses a “rules-based” template, it struggles to capture critical data from documents that do not follow a fixed layout. RPA, a legacy technology, has a reputation in the banking world for being “fragile,” inflexible, and difficult to maintain—driving much of the disillusionment about RPA as a “brittle” and unreliable technology.

Why loan processing automation needs modern AI

In traditional banking institutions, providing 24-hour support, responding to customer emails, approving applications, and organizing paperwork are all crucial to winning and retaining customers.

Fintech apps are changing the lending industry by offering faster, more accessible, and more responsive front-end processes. Unfortunately, legacy lenders who are stuck in legacy document workflows prone to manual errors and RPA weak points really struggle to keep up with these technological advancements.

This gives a competitive edge to newer fintech startups. However, lenders that can digitally transform their loan application processes will be able to provide a seamless and frictionless lending experience. Therefore, what traditional lenders need more than ever is a modern AI-driven automation technology that brings financial services like the loan process into the digital era.

In traditional banking institutions, providing 24-hour support, responding to customer emails, approving applications, and organizing paperwork is crucial to winning and retaining customers. Automated loan processing systems—with next-gen AI/cognitive document understanding—will close the gaps.

With intelligent document processing, legacy lenders are back in the driver’s seat.

How intelligent document processing (IDP) closes the gaps

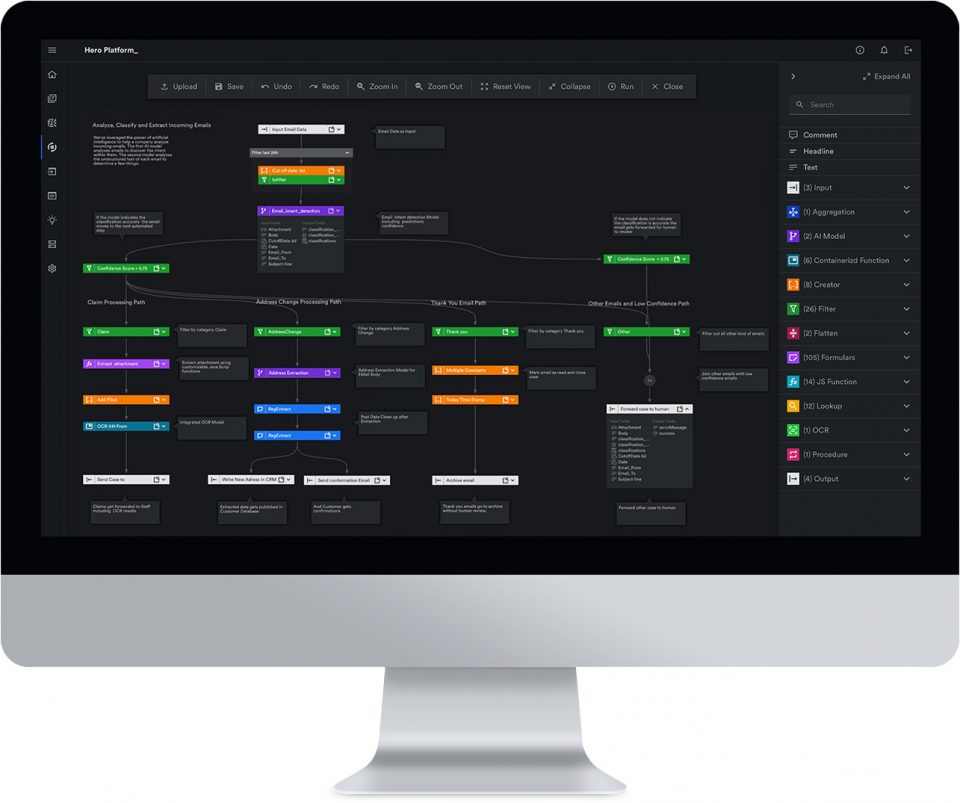

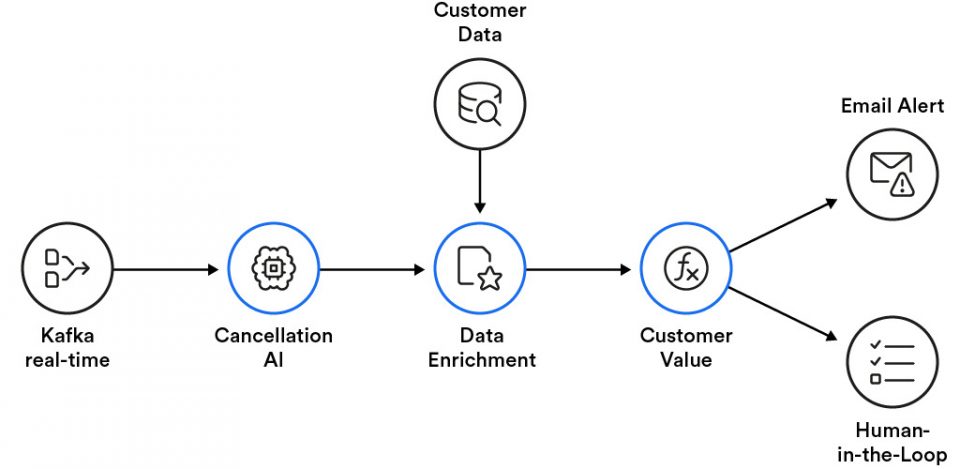

Next-wave loan automation platforms like Automation Hero streamline data extraction with above-human accuracy. For example, Automation Hero’s patent-pending context-aware optical character recognition (OCR) “reads” every kind of document (including images), extracts data, and formats it for processing by users or RPA bots.

Full-service intelligent document processing (IDP) platforms like Automation Hero’s Hero Platform_ can fully automate the entire loan application workflow—from document input to data output—with significantly higher accuracy than human underwriters.

Regardless of the structure or layout of information, Hero Platform_ extracts essential data from documents, including PDFs, emails, Word documents, scanned contracts, digital forms, and more. This lends the platform to several use cases in an automated loan processing system:

- Pre-approvals

- Appraisals

- Underwriting

- Closing

- Cross-selling and upselling

- Credit analysis

- Portfolio risk management

Benefits of modern automated loan processing systems

Higher-quality banking data

With so many manual tasks for underwriters to perform, there’s a risk of bad data quality entering your system. Bad data quality introduces risks in areas where high accuracy is needed. By removing manual steps in data entry and loan application reviews, the potential for human error is reduced, if not completely eliminated. Mistakes due to human error are expensive to fix. A modern loan processing system that uses industry-leading IDP streamlines loan processing times with above-human accuracy and significantly reduces the work of underwriting.

Faster customer onboarding

Opening an account can take up to 90 days. Long application delays are frustrating, and banks are under constant pressure to deliver services faster than the Fintech competition. The rise of digital loans, like the digital mortgage, and faster competition will leave legacy lenders behind. Modern loan automation solutions leveraging intelligent document processing can streamline customer onboarding and enhance the customer experience.

Shorter application processes

Loan officers handle many documents with critical information about a borrower’s income. This involves pay stubs, tax documents, bank statements, and even open-source content available on social media for a complete picture of all associated risks. In a modern loan automation system equipped with IDP, banking processes stuck under a mountain of unstructured documents—such as those essential to underwriting—can be streamlined with just one click.

Enhanced KYC compliance

Banks can’t know their customers if the data they have on them is stuck inside inaccessible documents. IDP unlocks essential data locked away in documents and mitigates the risks of customer onboarding. Hero Platform_’s IDP is particularly adept at comparing data points from multiple sources and analyzing them with above-human accuracy. Meet regulatory standards for KYC compliance, mitigate the associated risks with customer due diligence (CDD) checks, and fast-track every onboarding step throughout the customer journey.

Find new revenue opportunities

With IDP, lenders can gain insights into customer behavior and preferences, enabling them to deliver better services to customers that are tailored to meet their specific needs. For example, acquiring a new customer costs a bank $7,700. In addition, IDP helps bankers find new revenue streams from existing customers by offering cross-selling recommendations tailored to their specific needs. Ultimately, this can increase customer satisfaction and loyalty, which are critical in a highly competitive industry.

Automate common customer requests

IDP accelerates contactless banking by understanding the intent of email messages. Automation Hero’s intent classification automatically triages emails and tailors a perfect response for a first-class customer service experience.

For example, is the email a change of address request, proof of employment update, submission of ID verification materials, or a complaint? Hero Platform_ can detect intent in email messages. Using the extracted data, Hero Platform_ can look up information in another system, verify it, and automatically send replies to common inquiries—saving underwriters time and effort.

Join the digital loan processing revolution with Automation Hero

When RCBC decided to scale the use of AI, it knew the only way to increase its competitiveness was to optimize its customer onboarding experience. Learn how we helped one of the most trusted commercial banks in the Philippines increase its underwriting production 3x faster by reducing loan processing time from 25 days to just eight days using IDP.

- Speak with an expert — tell us about your specific use case.

- Get a personalized demo — schedule a demo, and our Heroes will get in touch!

- Access our Ebook — Learn how OCR and advanced AI can save legacy lenders.

Close Window

Automation Hero will track how you use the emails (e.g., at what time you open which part of the emails) sent by Automation Hero. If you have provided a separate declaration of consent that cookies for tracking your usage of the website and/or apps may be placed on your device, Automation Hero will also connect the information about your use of Automation Hero’s websites and apps (e.g., which information you open) collected by the tracking cookie to such information in so far as possible. Automation Hero will analyze such information, to identify your interests and preferences and to communicate with you in a more personalized and effective way, e.g. by providing information that you are likely interested in, like information on new technologies or products of the Automation Hero group that are likely relevant to you.